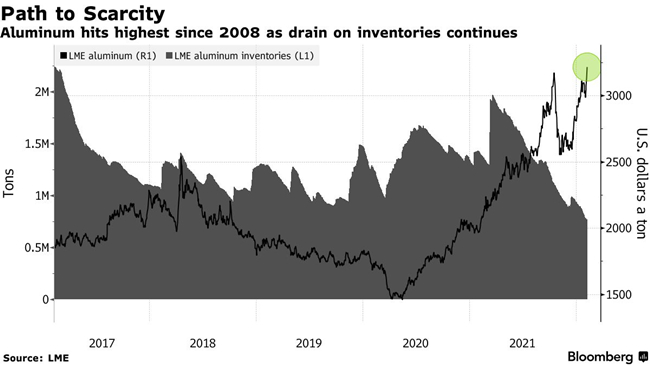

Aluminum Hits Highest Since 2008 on LME

Aluminum surged to a 13-year high in London as booming demand and a swath of smelter closures from China to Europe bring the risk of shortages of the crucial industrial metal.

Prices rose as much as 3.3% to $3,236 a ton on the London Metal Exchange, surpassing a peak in October to reach the highest since 2008. Aluminum is the best performer on the LME this year, and the next target for bullish investors who’ve been drawn into the rapidly tightening market is an all-time high above $3,380.

Key raw materials from nickel to crude oil have surged in recent months as consumption has risen sharply with the world emerging from the pandemic while supply hasn’t kept up, stoking inflation concerns. Goldman Sachs Group Inc. raised its 12-month target on aluminum to a record $4,000 a ton, citing supply disruptions stemming from power rationing in China and Europe at a time of “exceptional” developed-market demand.

“Aluminum markets are facing a melt-up in prices this year, driven by simultaneous deficits in both China and ex-China drawing on already low stock of inventory,” Goldman analysts including Nicholas Snowdon and Jeffrey Currie said in a note.

The global aluminum market is in the widest backwardation since 2018, and prices have risen 13% in London this year.

With smelters in Europe battling an energy crisis and Chinese supply at risk from a burgeoning Covid outbreak, buyers are drawing rapidly from stockpiles and pushing them to critically low levels.

“A key attribute of physical scarcity is that it has a propensity to spread, creating additional volatility in prices throughout the economy,” the Goldman analysts said in the emailed note.

The Bloomberg Commodity Spot Index, which tracks energy, metals and crop prices, climbed to its highest ever this month, and has more than doubled from a four-year low reached early in the pandemic.

Aluminum rose 1.6% to settle at $3,183 a ton at 5:53 p.m. on the LME. Other main LME metals were mixed, with copper little changed and nickel falling.

“It’s a perfect storm for aluminum right now, with the European energy crisis and the situation in China still restricting supply,” said Wenyu Yao, senior commodities strategist at ING Bank. Some investors have been long aluminum while shorting copper, according to Yao.

Source: Bloomberg

Related news

1 week ago · 5 mins read

1 week ago · 5 mins read

2 weeks ago · 5 mins read

2 weeks ago · 5 mins read