Suez Canal Blockade Pushes Freight Rates Further Upwards

More liner disruption caused by the week-long Suez blockage has pushed freight rates upwards again with the SCFI reaching a new historical high on 23 April. Traffic through the Suez Canal was blocked for 6.5 days by the grounded vessel EVER GIVEN (20,388 TEU). This blockage delayed many ships by one or two weeks, forcing carriers to blank sailings in both directions which reduced their possibility to reposition badly needed empty containers.

Carriers have effectively increased capacity on the major East West trades. Weekly average nominal capacity in the Asia to North America trade this week stand at 568,351 TEU, the highest level ever recorded and up 45.7% on a year-on-year-basis. This compares to 423,689 TEU for the Asia to Europe trade, up 24.7% compared to a year ago. All available ships are currently sailing. However cargo demand is exceeding maritime capacity. The lack of available container ships on the charter market also precludes carriers from fixing vessels on a voyage charter basis to return full ship loads of empties to Asia.

Easing port congestion would be the best remedy to get more container ships actively sailing again. The need to blank more sailings on East West trades in the coming weeks to restore schedule reliability and get vessels back in place will see liner service disruption continue throughout Q2. A normalization can be expected only in Q3 at the earliest.

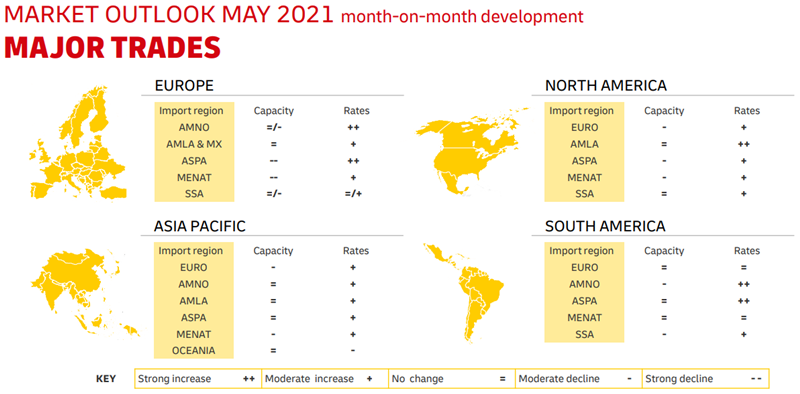

MARKET OUTLOOK MAY 2021 | OCEAN FREIGHT RATES – ASIA-PACIFIC EXPORTS

ASPA-EURO

The space situation remains tight in May with further blank sailings and vessel delays due to port congestion. Equipment situation remains tight.

ASPA-AMLA

The perfect storm returns for Asia-Latam with a concoction of high demand against capacity supply, equipment shortage and port congestions which results in higher ocean freight levels and service reliability issues. Situation is expected to last at least through whole May.

ASPA-MENAT

Demand vs supply gap persists in May leading to a tense market environment expected to last till June. This is prevalent across all of MEA trades, with the strongest rebound evident for Middle east and Red Sea markets with continued capacity withdrawal plans of approximately 30% capacity removed per week for April and May sailings. East Med also continues to be strong in demand with forced capacity withdrawal/blank sailings after the Suez Canal blockage incident. All segments of Africa remains at record high freight levels. Equipment supply is also becoming tight in recent weeks. Collectively, the signal from market is, that there will be no post golden week fluctuation or break in demand this year, while the current freight environment is generally expected to persist until June.

ASPA-ASPA

Space and equipment remain tight partly owing to the Suez Canal incident in March. All equipment types remain tight across Asia. Accurate forecast and 3-4 weeks advance booking remain a necessity in the current market. Situation expected to remain at least till end of May.

Source: DHL, Alphaliner, carriers

Related news

1 week ago · 5 mins read

1 week ago · 5 mins read

2 weeks ago · 5 mins read

2 weeks ago · 5 mins read